Craft a Powerful Business Prepare:Â Your business prepare need to present a comprehensive overview of one's business, like its mission, vision, and aims. It also needs to depth how the loan will contribute to accomplishing these objectives.

An extensive assessment of one's economical overall health is fundamental to securing a small business loan. Assessment your economical statements, which include balance sheets, earnings statements, and hard cash stream statements.

Business lines of credit are much like credit playing cards: A lender approves you for a set number of financing (much like a credit Restrict), which you'll be able to attract from at your discretion.

Cost savings. You can utilize the cash in your checking account to secure a business loan. Some lenders might desire funds as it’s probably the most liquid variety of collateral.

As the equipment by itself serves as collateral, you may not need to depend as closely on other standard business loan necessities, for example individual credit or time in business to qualify.

Jordan Tarver has invested seven many years covering mortgage, particular loan and business loan material for main financial publications for example Forbes Advisor. He blends awareness from his bachelor's diploma in business finance, his encounter as being a leading perf...

Scholar loans guidePaying for collegeFAFSA and federal college student aidPaying for job trainingPaying for graduate schoolBest personal scholar loansRepaying university student debtRefinancing university student financial debt

But this payment doesn't affect the knowledge we publish, or the evaluations which you see on This web site. We do not consist of the universe of how to get a business loan for equipment businesses or economic features that may be available to you.

NerdWallet has an engagement with Atomic Devote, LLC (“Atomic Invest”), an SEC-registered financial commitment adviser, to deliver you the opportunity to open up an investment advisory account (“Atomic Treasury account”). Financial commitment advisory services are provided by Atomic Spend. Providers which might be engaged by Atomic Make investments get payment of 0% to 0.85% annualized, payable monthly, primarily based on belongings underneath administration for each referred client who establishes an account with Atomic Make investments (i.e., exact payment will vary). Atomic Spend also shares a share of compensation gained from margin interest and free hard cash desire acquired by shoppers with NerdWallet. NerdWallet just isn't a customer of Atomic Invest, but our engagement with Atomic spend gives us an incentive to refer you to definitely Atomic Commit instead of A further investment decision adviser.

Confirm Lender Credentials: Check the credentials and history of likely lenders. Confirm their registration, licensing, and regulatory compliance. This may enable keep away from cons and make sure you’re coping with a genuine lender.

Might be reduce than unsecured business loans, dependant upon the lender and your Total qualifications.

Most secured business loan applications can be finished online, but some lenders may well require a telephone connect with or in-individual take a look at. Considering that the lender must critique your belongings, secured business loans usually just take more time to approve and fund.

Particular inbound links may well direct you clear of Lender of The united states to unaffiliated web pages. copyright has not been linked to the preparing of your material supplied at unaffiliated internet sites and doesn't warranty or believe any duty for their content.

When you’re in search of a versatile sort of financing for your personal small business—a single which can help you deal with cash movement gaps, access extra working capital, deal with an emergency, or make use of a business possibility—then a business line of credit may be a healthy.

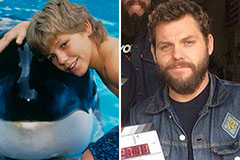

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Mason Reese Then & Now!

Mason Reese Then & Now! Bo Derek Then & Now!

Bo Derek Then & Now! Katey Sagal Then & Now!

Katey Sagal Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!